indiana excise tax on heavy equipment rental

This type of equipment was previously subject to personal property tax however HEA 1323 2018 imposes this new tax type effective January 1 2019. The renter is liable for the tax and it will be.

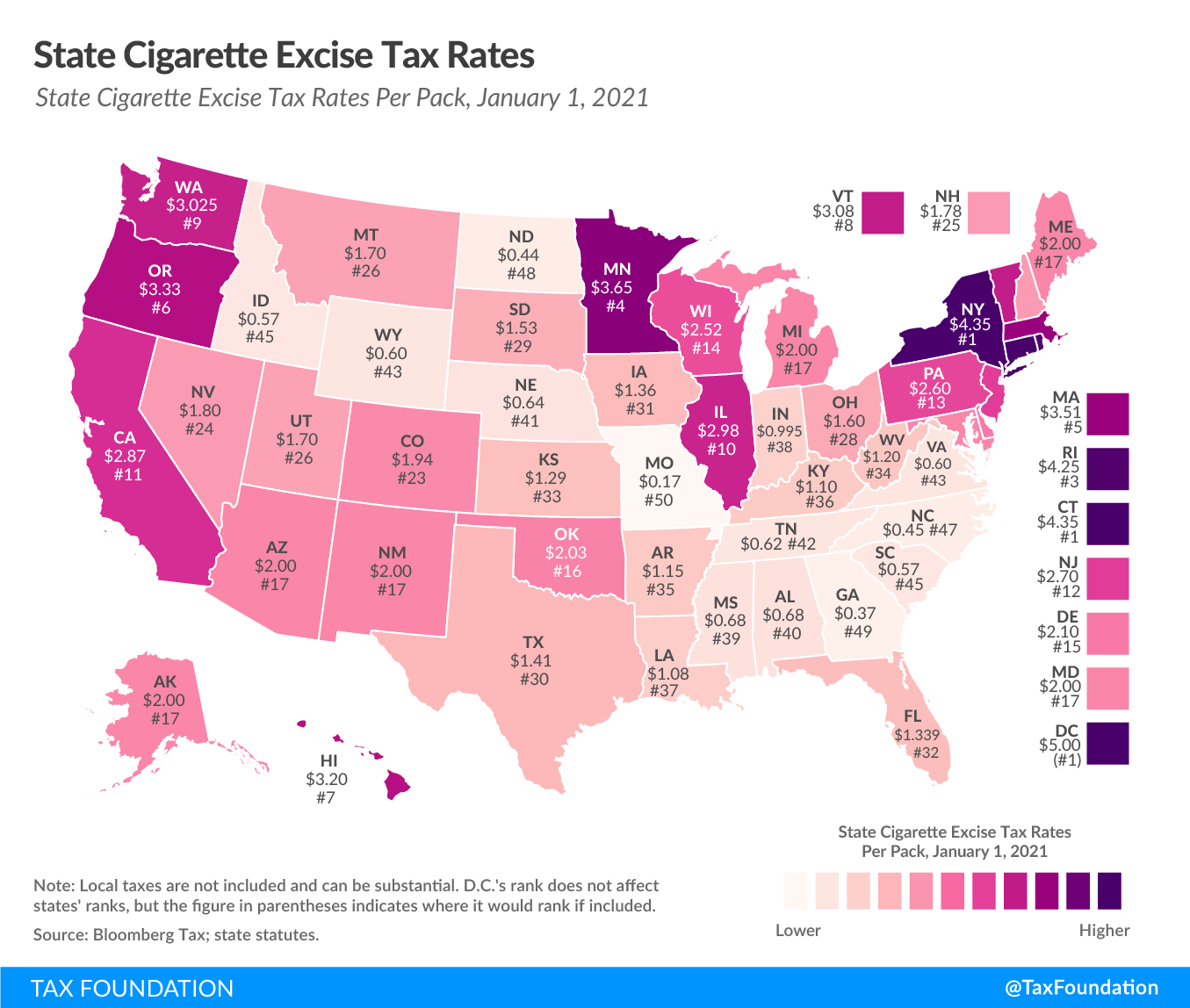

Excise Taxes Excise Tax Trends Tax Foundation

Imposes a rental excise tax on the rental of.

. Provides that the owner of a motorized heavy equipment vehicle is required to register the vehicle each year with the department of state revenue. The heavy equipment rental. To qualify the rental period must not exceed 365 days or must be open ended with no specified end date.

As stated in 6-6-15-3 the excise tax will be 225 of the gross retail income received by the retail merchant for the. Indiana has enacted a new excise tax on the rental of heavy equipment. The heavy equipment rental excise tax applies to the rental of all personal.

2021 Indiana Code Title 6. A All revenues collected from the heavy equipment rental excise tax. Indiana implemented a new excise tax on the rental of heavy equipment that took effect on January 1 2019.

Provides that after December 31 2019 excise. The legislation imposes a new excise tax upon the rental of heavy rental. The rental excise tax is 225 of the gross retail rental income.

Heavy Equipment Rental Excise Tax The heavy equipment rental excise tax is imposed on the gross retail income received from the rental of tangible personal property from a business in. Section 6-6-15-6 - Payment and sourcing of the tax. Section 27 of SEA 565-2019 effective July 1 2019 expanded the list of heavy rental equipment that is exempt from excise taxation to include any of the following.

To qualify the rental period must not exceed 365 days or must be open ended with no specified end date. 1 2019 Indiana implemented a new excise tax on the rental of heavy equipment from a location in Indiana. The tax was created.

A All revenues collected from the heavy equipment rental excise tax must be deposited in a special account of the state general fund called the heavy equipment rental. Provides that the excise taxes distributed to the units before January 1 2020 must be deposited in the units excess levy fund. Credit for misclassification Section 6-6-15-7 - Heavy equipment rental excise tax account.

The legislation imposes a new excise tax upon the rental of heavy rental. What is the Indiana Heavy Equipment Excise Tax. The new Indiana excise tax will be assessed on.

The rental excise tax is 225 percent of the gross retail rental. Motor Fuel and Vehicle Excise Taxes Chapter 15. During the legislative session of the Indiana General Assembly for 2018 the state of Indiana enacted and the Governor signed into law House Enrolled Act No.

Distributions and apportionment of the tax Make. Starting January 1 2019 Indiana will implement a new excise tax on the rental of heavy equipment and construction equipment. The Indiana Department of Revenue has issued a directive from the commissioner regarding the states new heavy equipment rental excise tax effective January 1 2019.

Get A Big Tax Break When You Buy Heavy Equipment News Heavy Metal Equipment Rentals

Heavy Equipment Rentals In Indiana Macallister Machinery

General Rental Sales Equipment Party Rentals Washington In

Business Tax Deadlines Remain Unchanged For Upcoming Months

General Rental Sales Equipment Party Rentals Washington In

Top 10 Benefits Of Construction Equipment Telematics

Tractor Overseeder Attachment Rentals Fort Wayne In Where To Rent Tractor Overseeder Attachment In Columbia City In Churubusco South Whitley Warsaw Ft Wayne In

Taxnewsflash United States Kpmg United States

Motor Fuels Taxes In A Changing Texas Transportation Scene

Excise Taxes Excise Tax Trends Tax Foundation

Indiana Tax Developments Spring 2022 Us Tax Disputes

Ben Ruble Owner Patriot Truck Leasing Of Indiana Llc Linkedin

Electric Car Rebates And Incentives What To Know By State Kelley Blue Book

Excise Tax In The United States Wikiwand

Rebates And Tax Credits For Electric Vehicle Charging Stations

Atlas Handlers Line Adds Mid Atlantic Dealer Recycling Today